is maine tax friendly to retirees

Retirement income tax breaks start at age 55 and increase at age 65. Average property tax 607 per 100000 of assessed value 2.

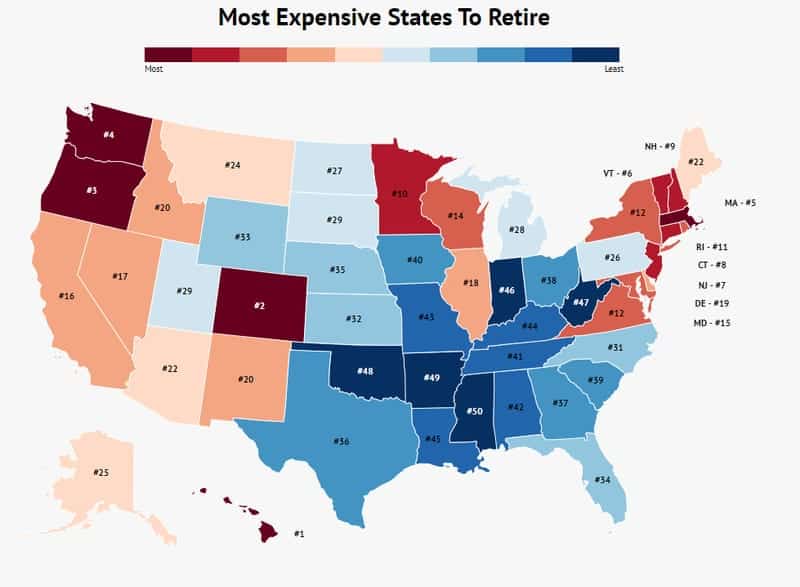

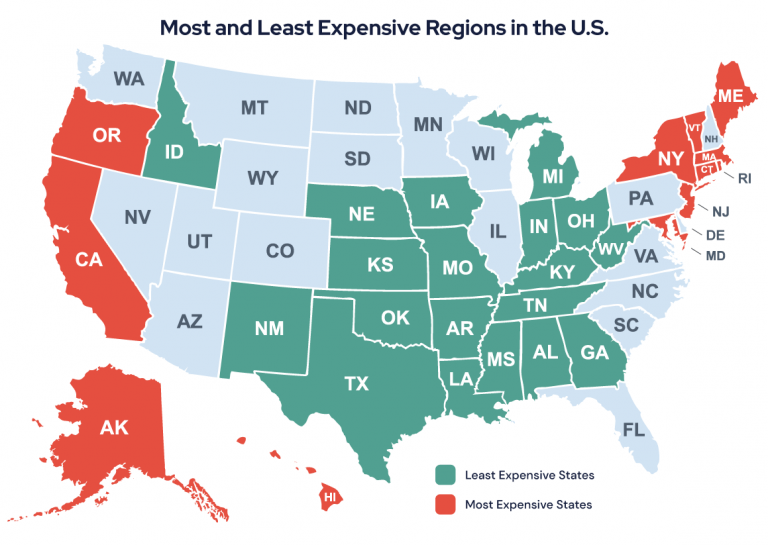

Don T Retire In These 10 States If You Want To Keep Your Money The Most Expensive States To Retire Zippia

For nature lovers and those looking to retire in a.

. Is Maine Tax Friendly To Retirees. You may also know that most VA. Median Property Tax Rate.

On the other hand if you. The 10000 must be reduced by all taxable and nontaxable social security and railroad benefits. Is maine a tax friendly state for retirees.

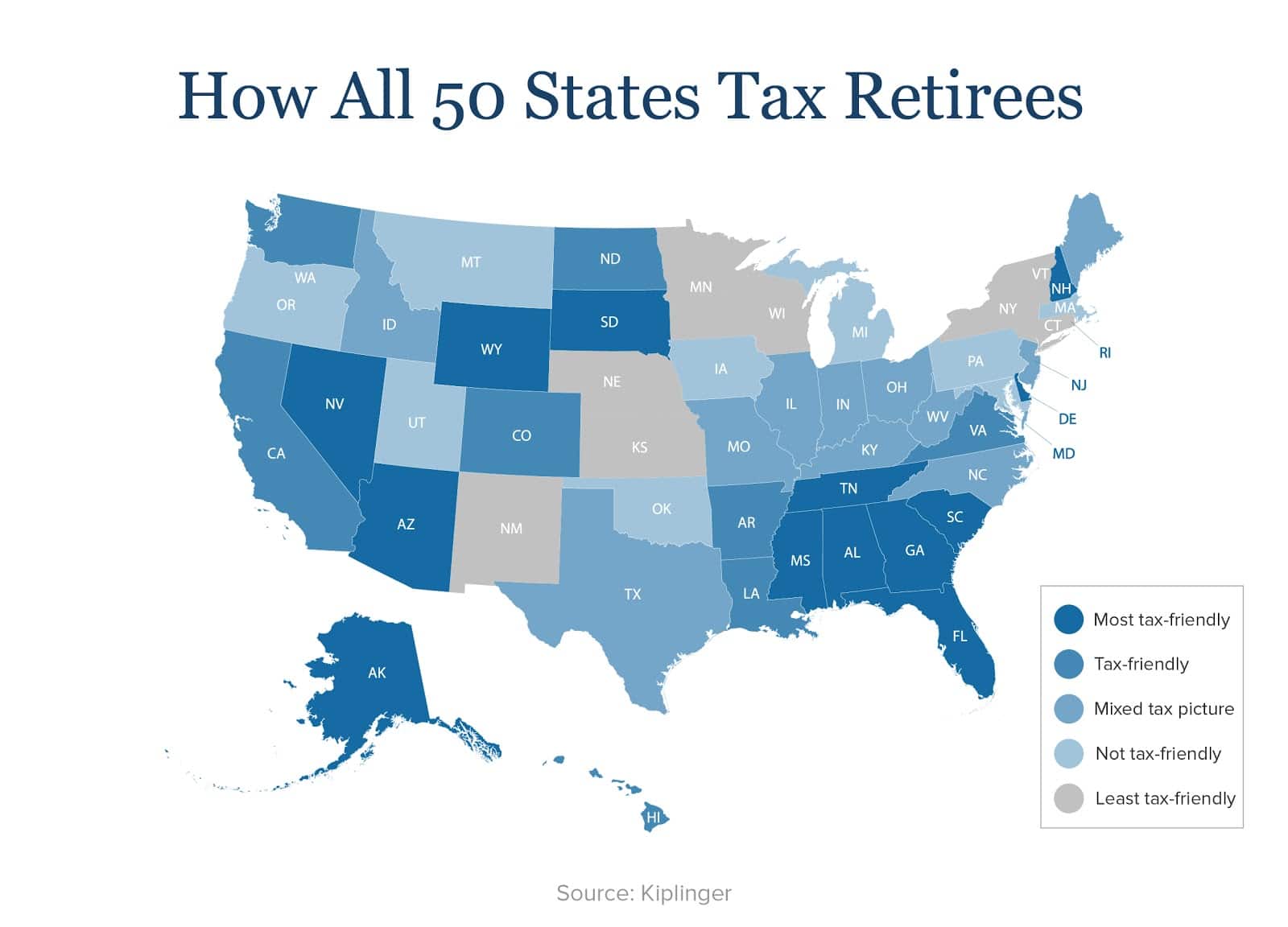

Flat 463 income tax rate. Maine Retirement Tax Friendliness Smartasset Is Maine tax-friendly for retirees. Social Security is exempt from taxation in.

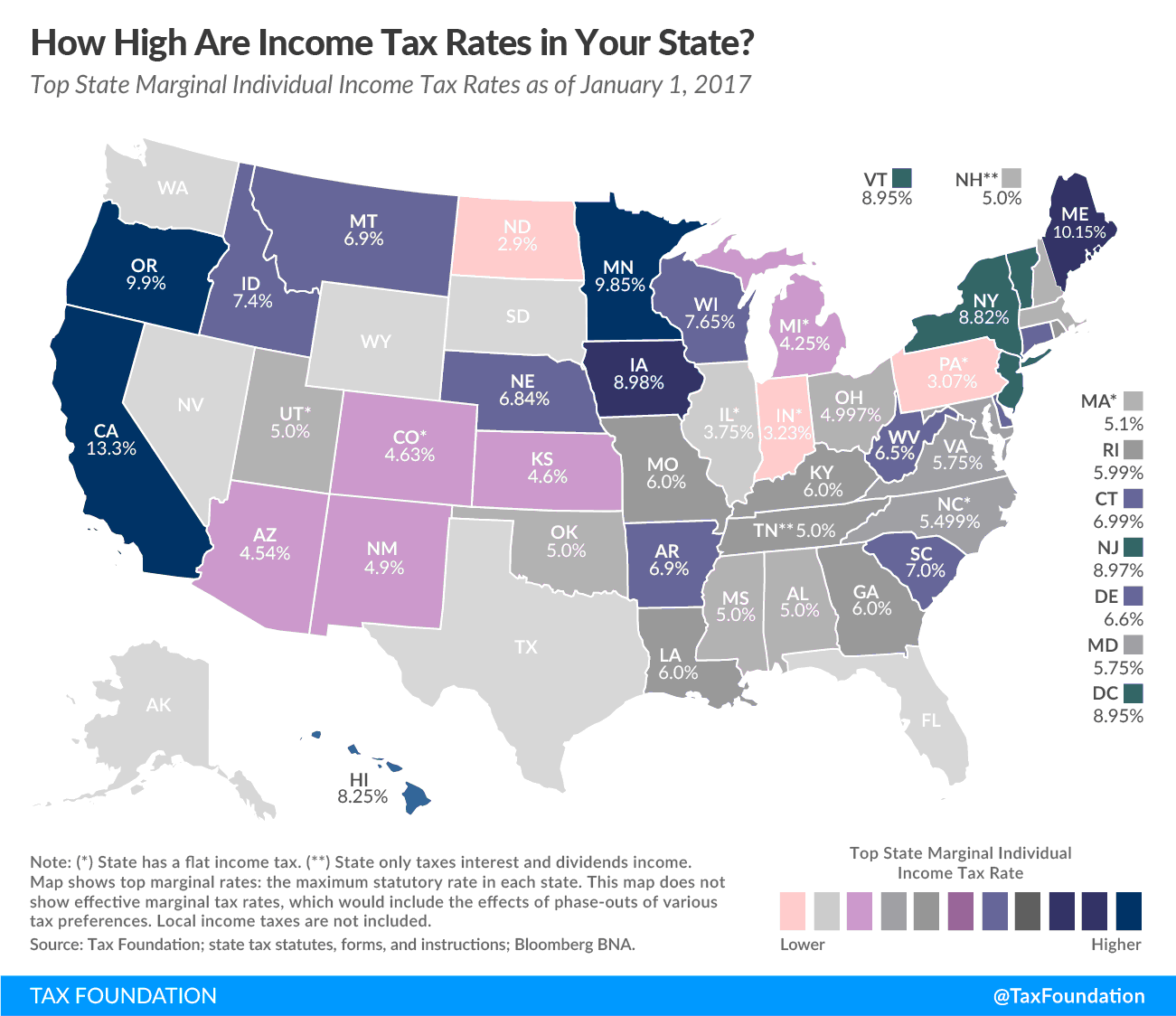

Maine with a tax burden of just over 10 is the ninth highest in the country. On the other hand taxes in a state like. State sales and average local tax.

If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Marginal Income Tax Rates.

1 The cost of living is reasonable. Here are 12 reasons why Maine is one of the best places to retire. In terms of weather Maine is undoubtedly the better state as it has one of the countrys friendliest.

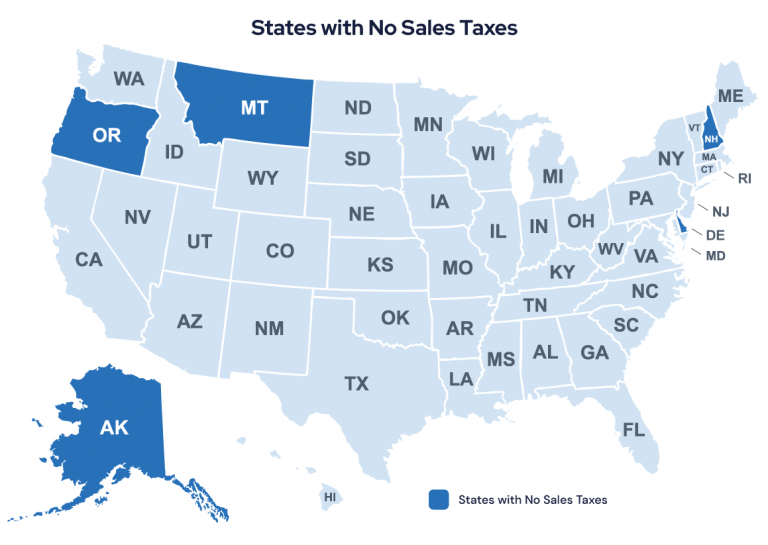

If you believe that your refund may be. Congratulations Delaware youre the most tax-friendly state for. State tax on Social Security.

Income tax rate 65. Seniors who receive retirement income from a 401k ira or pension will pay tax rates as high as 715. South Carolina has the fourth-lowest.

Maine does not tax social security income. The states that dont tax pension plans extend those same. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

Maines income tax rate ranges from 58 to a top. In a state like Wyoming which has no income tax along with low sales and property taxes retirees can expect to have a very small tax bill. While the Northeast as a whole is pricier than destinations with milder climates.

Is Maine tax-friendly for retirees. 568 per 100000 of assessed home value. Social Security and public pensions are exempt from taxation but the Aloha State taxes private pensions and income from retirement saving plans at rates of up to 11.

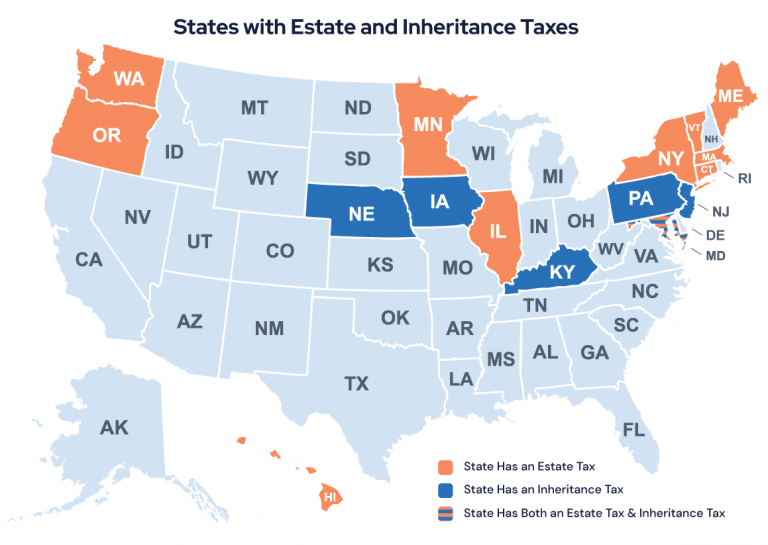

According to Sperlings Best Places an online data resource the cost of housing. Married filers that both. Estate Tax or Inheritance Tax.

The states property taxes are somewhat higher than the national average at a 130 effective rate. However the best state to retire in greatly depends on your personal preferences.

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

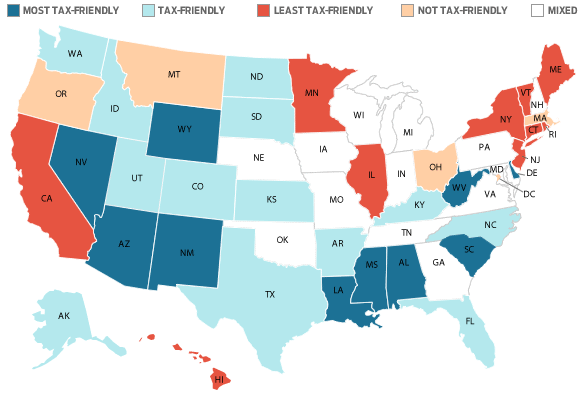

A Guide To The Best And Worst States To Retire In

Aloha State Makes Least Tax Friendly List Maui Now

Most Tax Friendly States For Retirees Ranked Goodlife

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Best States To Live In Retirement

A Guide To The Best And Worst States To Retire In

Maine Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

How To Plan For Taxes In Retirement Goodlife Home Loans

Least Tax Friendly States For Retirement Kiplinger S Personal Finance 03 17 14 Skloff Financial Group

7 States That Do Not Tax Retirement Income

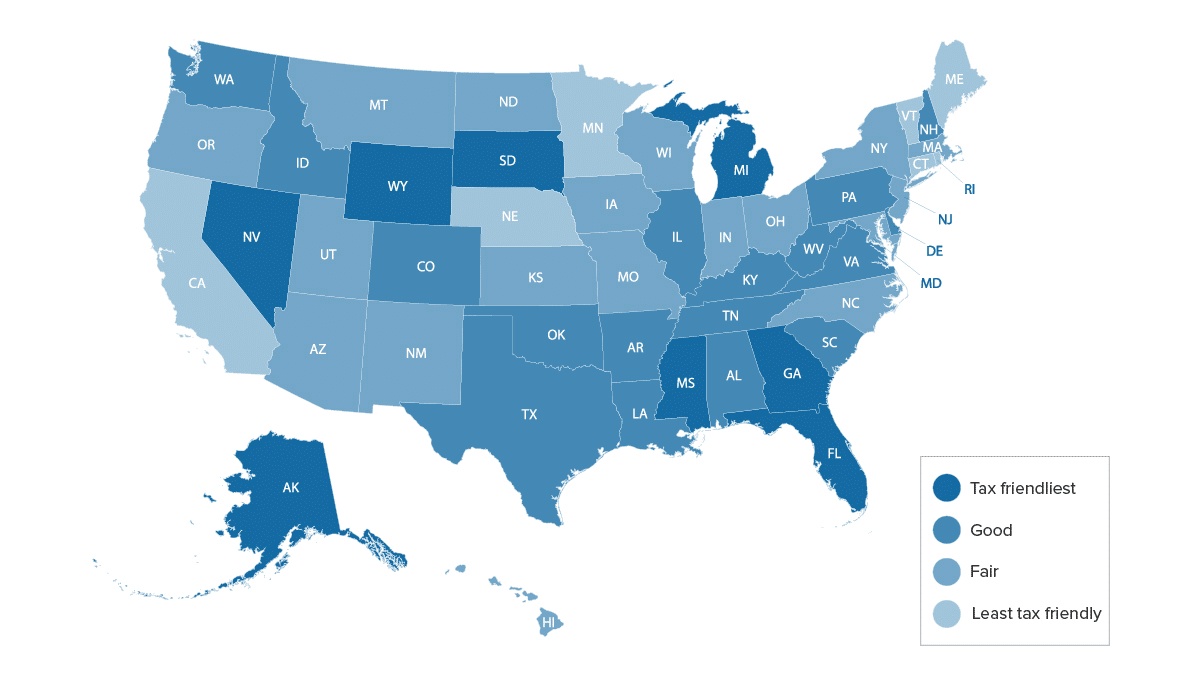

Most Tax Friendly States For Retirees Ranked Goodlife

Most Tax Friendly States For Retirees Ranked Goodlife

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine

The Most Tax Friendly States For Retirees Vision Retirement

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine